Forecast Updates: Stronger dollar, risks to inflation

Donald Trump’s victory in the US presidential elections requires a recalibration of our forecasts.

A wave of red in the US presidential elections will bolster the dollar.

We have seen that even before the results of the elections were out. With a fresh mandate as president, a Donald Trump win affirms the persistent dollar story, with the dollar spot index at a four-month high of 105.44 a day after the elections.

However, the recent dovish 25-basis-point cut by the US Federal Reserve (Fed), which widens the interest rate differential of the Bangko Sentral ng Pilipinas (BSP) and the Fed, could slightly offset the effects of a stronger US dollar.

With the control of the lower house still in question, Metrobank Research sees two scenarios in the potential movement of the peso, taking into account proposed policies of the new US administration, and the expected support to the peso from incoming Business Process Outsourcing companies’ bonuses and overseas Filipino workers’ remittances in the 4th quarter.

Incoming US President Trump’s push towards increasing tariffs, especially the proposal to impose at least 60% tariff rate on imports coming from China, may push through regardless of the composition of Congress as the said policy does not require a Congressional approval.

However, some of Trump’s other proposed tax policies – including the reduction of corporate taxes to 15% from the current 20%-21%, as well as the extension of some tax cut provisions under the Tax Cuts and Jobs Act (TCJS) – would have lower chances of being implemented or may take longer to enforce through legislation should there be resistance from a possibly Democrat-dominated House of Representatives.

These proposals, when passed, would widen the US budget deficit and nudge the US government to increase borrowings. A narrowing trade deficit in the US, along with higher government borrowings, will lead to higher US Treasury yields and further strengthen the dollar.

Because the US is the world’s largest economy, the strengthening of the dollar will lead to further weakening of other currencies. This could also offset domestic inflows that support the peso.

With the control of the lower house still in question, we see two scenarios in the potential movement of the peso.

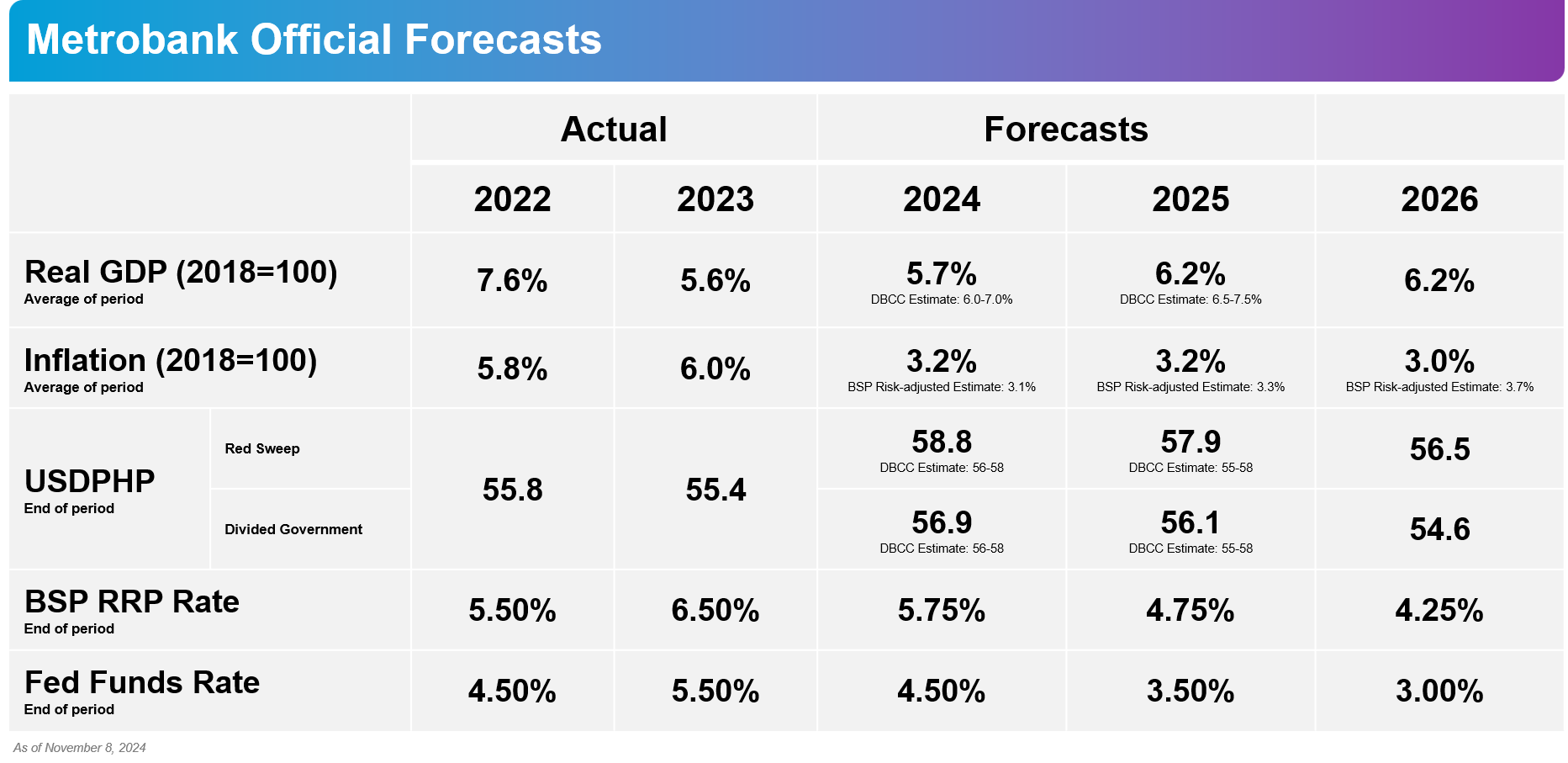

If Republicans take majority of the seats in the lower house, thus allowing full Republican control of the US government, we expect peso depreciation throughout the rest of the year. Under this scenario, we nudge our year-end USD/PHP forecast upward to 58.8 for 2024, 57.9 for 2025 and 56.5 for 2026.

On the other hand, if the Democrats dominate the lower house, resulting in a divided US government, we expect some resistance in the implementation of Republican policies. If that happens, we expect the reversal to continue and the peso to appreciate towards the end of 2024, although not as much as previously estimated. In this situation, we are nudging our year-end USD/PHP forecast upward to 56.9 for 2024, 56.1 for 2025 and 54.6 for 2026.

Inflation to accelerate in FY 2025, but within target

The latest inflation print in October, which brings year-to-date inflation to 3.3%, confirms our expectations that inflation will stay within the 2-4% inflation target of the Bangko Sentral ng Pilipinas (BSP).

With this, we maintain our average FY2024 forecast at 3.2%. Given the projected impact of the BSP’s easing cycle on consumption, we nudge our FY2025 inflation forecast upward to 3.2% as we expect higher demand-side pressure. For 2026, we maintain our 3.0% full-year average forecast, barring any supply side shocks.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research