Inflation Update: Prices rise even slower in May

DOWNLOAD

DOWNLOAD

Monthly Recap: BSP to outpace the Fed in rate cuts

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: 5.4% Q12025

DOWNLOAD

DOWNLOAD

TOP SEARCHES

Inflation likely eased in October — poll

By Keisha B. Ta-asan, Reporter

HEADLINE INFLATION likely eased to below 6% in October due to lower prices of some food items and a rollback in pump prices, analysts said.

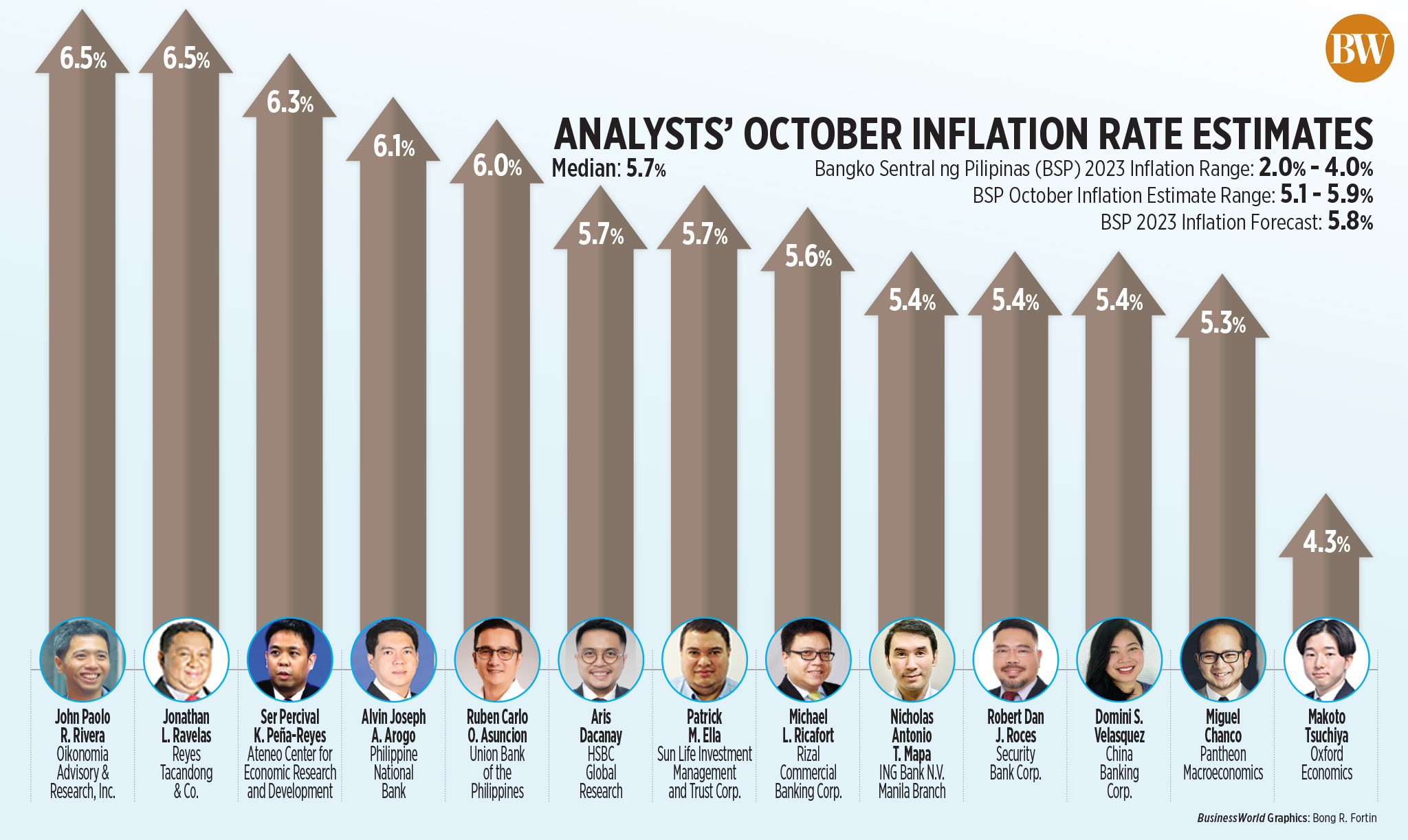

A BusinessWorld poll of 13 analysts conducted this week yielded a median estimate of 5.7% for the consumer price index (CPI) in October. This is within the 5.1-5.9% forecast of the Bangko Sentral ng Pilipinas (BSP) for the month.

If realized, October inflation would be slower than 6.1% in September and 7.7% in the same month last year. It would also be the slowest rate in two months or since 5.3% in August.

However, October would still mark the 19th straight month inflation breached the central bank’s 2-4% target band.

The local statistics agency will release the October consumer price index (CPI) data on Nov. 7 (Tuesday).

“Although still elevated, headline inflation likely eased to 5.7% from 6.1% in the previous month. Global oil prices have tapered from the peak in September, which led to lower fuel prices domestically,” HSBC economist for ASEAN Aris Dacanay said in an e-mail.

In October alone, oil companies cut pump prices for gasoline by P3.1 per liter, diesel by P0.45 per liter, and kerosene by P4.40 per liter, data from the Energy department showed.

“Our latest data show some easing in the cost of essential food items such as rice, meat, and vegetables, as well as reductions in electricity and pump prices this October. While these factors could alleviate inflationary pressures, they may not be substantial enough to warrant diminished vigilance from the central bank given upside risks,” Security Bank Corp. Chief Economist Robert Dan J. Roces said.

Data from the Agriculture department showed that prices of beef rump ranged from P390 to P480 a kilo as of Oct. 31, narrower than the P390 to P550 band on Sept. 29. Retail prices of cabbage, white potato and chayote also fell.

However, Mr. Dacanay noted headline inflation may have remained sticky in October as rice prices remain elevated although easing from their high in September.

“To balance the welfare between producers and consumers, authorities decided to lift the price cap of rice in the first week of October without a corresponding decrease in tariff rates. This likely led to some upward correction in the price of rice, keeping overall inflation elevated,” he said.

The prices of local regular milled rice ranged from P41 to P44 a kilo as of Oct. 31, while well-milled rice ranged from P45 to P53.

Prices of rice have steadied after President Ferdinand R. Marcos, Jr. lifted the rice price ceiling on Oct. 4. In September, Mr. Marcos ordered prices to be capped at P41 a kilo for regular milled rice and P45 for well-milled rice.

Meanwhile, Philippine National Bank economist Alvin Joseph A. Arogo said in an e-mail that higher jeepney fares and recent minimum wage adjustments may have also put upward pressure on inflation in October.

Starting October, traditional and modern jeepneys increased their fares by P1 to P13 and P15, respectively.

Wage adjustments in Cagayan Valley, Central Luzon, and Soccsksargen regions took effect on Oct. 16. Regional wage boards recently approved a P30-P35 increase in the daily minimum wages for Ilocos and Western Visayas regions, which will be implemented on Nov. 6.

China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message that higher cooking gas prices and an increase in electricity rates in Metro Manila and Batangas likely added to prices pressures in October.

Liquefied petroleum gas (LPG) prices rose by P3.75 a kilogram in October, its third straight month of increase. AutoLPG prices likewise went up by P2.09 a liter.

Manila Electric Co. hiked the rate for a typical household by P0.4201 per kilowatt-hour (kWh) to P11.8198 in October.

“Meanwhile, core inflation continued its downward trajectory to 5.2% from 5.9% (in September),” Ms. Velasquez said. Core inflation excludes volatile prices of food and fuel.

BACK TO TARGET?

Analysts said it is still possible for headline inflation to return to the 2-4% target band within the fourth quarter this year.

“We think CPI growth within 2%-4% is still achievable within Q4, barring another supply-side shock. However, risks are skewed to the upside and it’s possible that CPI growth will not return to the target band this year,” Makoto Tsuchiya, assistant economist from Oxford Economics, said in an e-mail.

BSP Governor Eli M. Remolona, Jr. earlier said headline inflation may not hit the 2-4% target this year but will instead ease to within target “very briefly” in the first few months of 2024.

He expects inflation will then pick up before easing again in July.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco in an e-mail said the BSP chief’s inflation projection is “far too pessimistic.”

“I still see a half-decent chance that inflation returns to the 4% mark by the end of this year, and it’s worth noting that core inflation has continued to fall, despite the recent increase in the headline rate in recent months, underscoring the waning underlying price pressures amid the weakening in economic growth,” he said.

Ms. Velasquez said inflation will likely reach the 2-4% target in the first quarter of next year, before rising again through July.

“We anticipate inflation to slow for the remainder of the year barring new shocks. Easing price pressures could hold off additional rate hikes from the BSP,” she said.

Mr. Arogo said his baseline estimates show that inflation may remain above 4% until the third quarter of 2024 due to persistent supply issues and second-round effects.

Last week, the BSP hiked borrowing costs by 25 basis points (bps) in an off-cycle move, bringing the key rate to a fresh 16-year high of 6.5%. The BSP has raised policy rates by 450 bps since May 2022.

The BSP sees full-year inflation at 5.8% for 2023, before easing to 3.5% in 2024 and 3.4% in 2025. Officials have said the BSP would revise its inflation forecasts on Nov. 16.

The BSP’s next policy-setting meeting is scheduled on Nov. 16.

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld