Inflation Update: Price-rise surprises at 2.1% in February

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Somewhat less dovish

DOWNLOAD

DOWNLOAD

Policy Rate Updates

DOWNLOAD

DOWNLOAD

TOP SEARCHES

All Risks

Investments that strike a balance between gains and risks

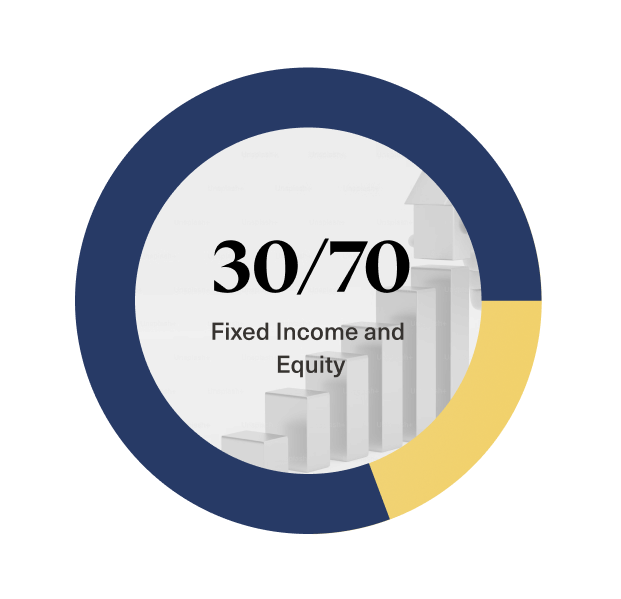

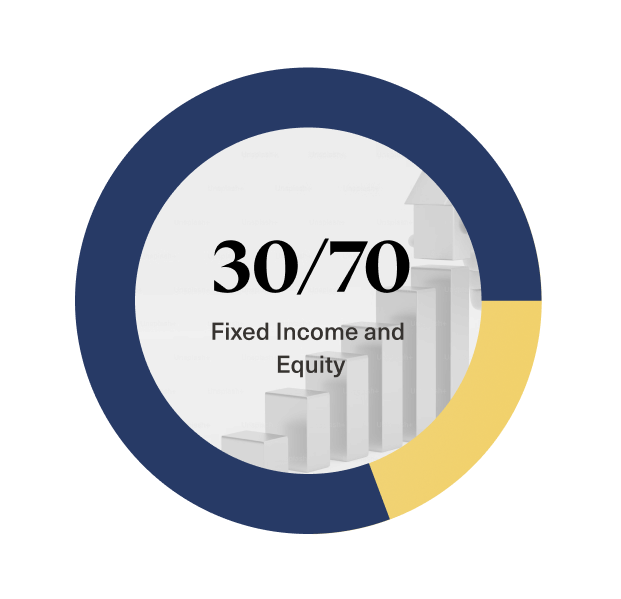

A balanced portfolio combining the stability of Fixed Income & Equity

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIO

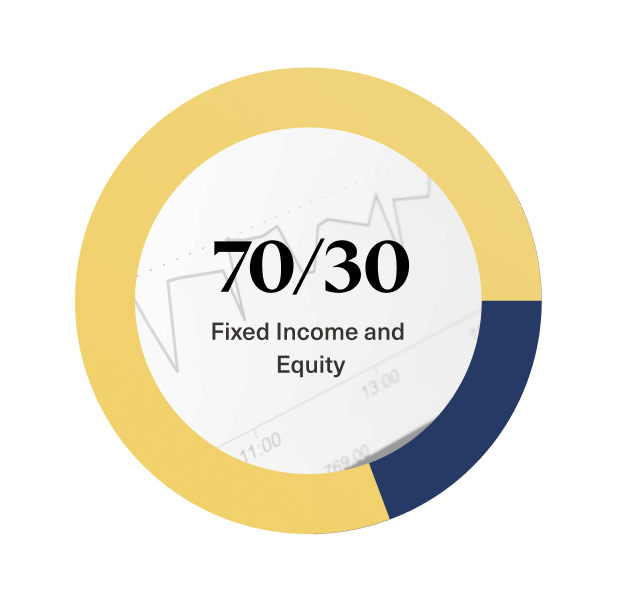

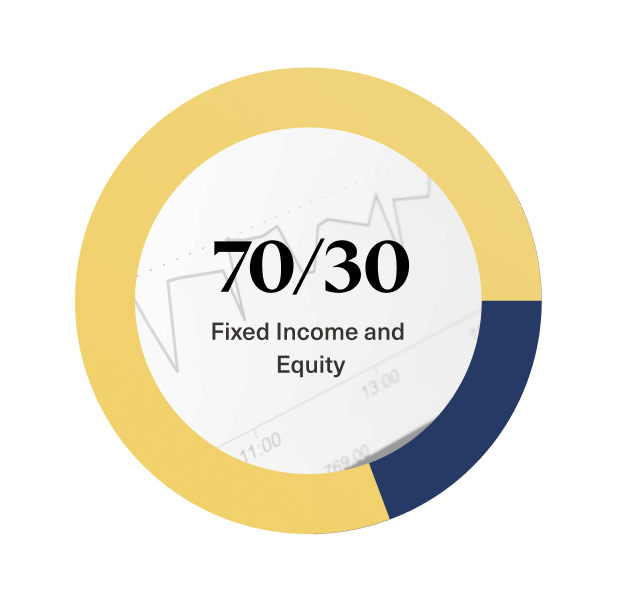

A growth-focused strategic portfolio with higher risk

This portfolio splits investments evenly between money market instruments and fixed income securities, offering a blend of stability and income potential. With a moderate level of risk, it provides a balanced approach that seeks to preserve capital while generating steady returns through fixed income assets.

VIEW PORTFOLIO

A growth-focused strategic portfolio with higher risk

This portfolio combines fixed income investments with equities, offering a balance of stability and growth. While the fixed income portion provides a steady income stream, the 30% equity allocation introduces higher risk and growth potential. It’s designed for investors seeking a higher return than traditional fixed income strategies, but with a willingness to accept increased market volatility.

VIEW PORTFOLIO

A fixed income portfolio with moderate risk for steady returns

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIO

A balanced portfolio combining the stability of Money Market & Fixed Income

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIO

A low-risk, conservative portfolio for safety & liquidity

This portfolio focuses entirely on money market instruments, offering a conservative investment approach with minimal risk. It is designed for investors prioritizing the safety of principal and liquidity, making it an ideal choice for those with a low tolerance for risk or a short-term investment horizon.

VIEW PORTFOLIOConservative Risks

Investments that focus on market stability and liquidity over making a considerable amount or higher gains

A low-risk, conservative portfolio for safety & liquidity

This portfolio focuses entirely on money market instruments, offering a conservative investment approach with minimal risk. It is designed for investors prioritizing the safety of principal and liquidity, making it an ideal choice for those with a low tolerance for risk or a short-term investment horizon.

VIEW PORTFOLIOModerate Risks

Investments that strike a balance between gains and risks

A fixed income portfolio with moderate risk for steady returns

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIO

A balanced portfolio combining the stability of Money Market & Fixed Income

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIOAggressive Risks

Investments that maximize gains but with higher potential risk

A balanced portfolio combining the stability of Fixed Income & Equity

This portfolio consists entirely of fixed income securities, such as bonds, offering a moderate level of risk with the potential for steady income. It is ideal for investors seeking a balance between capital preservation and higher returns than money market options, while accepting some fluctuation in value.

VIEW PORTFOLIO

A growth-focused strategic portfolio with higher risk

This portfolio splits investments evenly between money market instruments and fixed income securities, offering a blend of stability and income potential. With a moderate level of risk, it provides a balanced approach that seeks to preserve capital while generating steady returns through fixed income assets.

VIEW PORTFOLIO

A growth-focused strategic portfolio with higher risk

This portfolio combines fixed income investments with equities, offering a balance of stability and growth. While the fixed income portion provides a steady income stream, the 30% equity allocation introduces higher risk and growth potential. It’s designed for investors seeking a higher return than traditional fixed income strategies, but with a willingness to accept increased market volatility.

VIEW PORTFOLIO